Content

The company emphasized “net leverage”, which excluded these assets. On that basis, https://online-accounting.net/ Lehman held $373 billion of “net assets” and a “net leverage ratio” of 16.1.

- Gamblers might also want to leverage health information—if a player is injured, for instance, the opposing team might seem like a better bet.

- Improve your vocabulary with English Vocabulary in Use from Cambridge.

- The two most common financial leverage ratios are debt-to-equity (total debt/total equity) and debt-to-assets (total debt/total assets).

- Losing investments are amplified, potentially creating drastic losses.

- A debt-to-equity ratio greater than one means a company has more debt than equity.

- Being the only industry in town gave the company considerable leverage in its union negotiations.

The debt-to-equity (D/E) ratio indicates how much debt a company is using to finance its assets relative to the value of shareholders’ equity. A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt, or that assesses the ability of a company to meet financial obligations. An automaker, for example, could Leverage dictionary definition borrow money to build a new factory. The new factory would enable the automaker to increase the number of cars it produces and increase profits. Instead of being limited to only the $5 million from investors, the company now has five times the amount to use for growth of the company. A company can also compare its debt to how much income it makes in a given period.

English

Their voices and their power to make real change to improve gender diversity. She was able to leverage her travel experience and her gift for languages to get a job as a translator. Defenestration The fascinating story behind many people’s favori… But Tesla, in particular, has struggled this year in part because of CEO Elon Musk’s attempt to leverage his massive Tesla stake to purchase Twitter.

- Others worry that with younger, less experienced pilots among their ranks, some collective bargaining leverage would be lost.

- Therefore, a debt-to-equity ratio of .5 may still be considered high for this industry compared.

- For example, lenders often set debt-to-income limitations when households apply for mortgage loans.

- Companies use leverage to finance their assets—instead of issuing stock to raise capital, companies can use debt to invest in business operations in an attempt to increase shareholder value.

- Although these two are often confused, they are in fact opposite.

- The construction company is using debt to increase its return for shareholders.

That means a $1,000 down payment can be turned into a $125,000 gamble. If you have leverage, you hold the advantage in a situation or the stronger position in a contest, physical or otherwise. Developers could use Azure OpenAI to build apps that leverage AI for support tickets or for content matching to improve search results in online stores. They recognize that public support strengthens the moorings of federal institutions and gives them additional leverage in interactions with other levels of government. However, today this second category of players has much less economic, political and military leverage. The money could be used to leverage millions of additional dollars. Even if banks were able to rush back into heavy leverage soon, investors wouldn’t stand for it.

Dictionary entries near leverage

This may require additional attention to one’s portfolio and contribution of additional capital should their trading account not have a sufficient amount of equity per their broker’s requirement. Using leverage can result in much higher downside risk, sometimes resulting in losses greater than your initial capital investment. On top of that, brokers and contract traders will charge fees, premiums, and margin rates. Even if you lose on your trade, you’ll still be on the hook for extra charges. The greater the leverage, the greater the possible gain or potential loss.

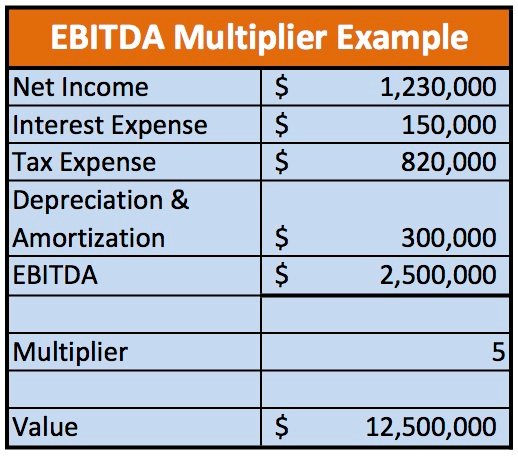

- DuPont analysis uses the “equity multiplier” to measure financial leverage.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- However, modern dictionaries (such as Random House Dictionary and Merriam-Webster’s Dictionary of Law) refer to its use as a verb, as well.

- Leverage refers to the use of debt to amplify returns from an investment or project.

- A corporation that borrows too much money might face bankruptcy or default during a business downturn, while a less-leveraged corporation might survive.

- Furthermore, the EBIT may decrease, thus lowering the earnings per share.

In business, a firm that uses borrowed funds to increase itsreturn on equityincurs the risk that itsreturn on assetsis less than the cost of borrowed funds. If the firm fails to meet its short-term obligations, it may go bankrupt.

Leverage vs. Margin

When a company issues common stock to raise money, it gives up a portion of its ownership to shareholders. When a company issues corporate bonds or takes out a loan, on the other hand, it is able to invest in new projects without relinquishing any ownership. When a company’s debt-financed investment pays off by increasing income, the company’s return on equity increases because it didn’t issue additional equity in order to boost income.